"area man" (hurrburgring)

"area man" (hurrburgring)

06/09/2014 at 10:09 • Filed to: None

1

1

15

15

"area man" (hurrburgring)

"area man" (hurrburgring)

06/09/2014 at 10:09 • Filed to: None |  1 1

|  15 15 |

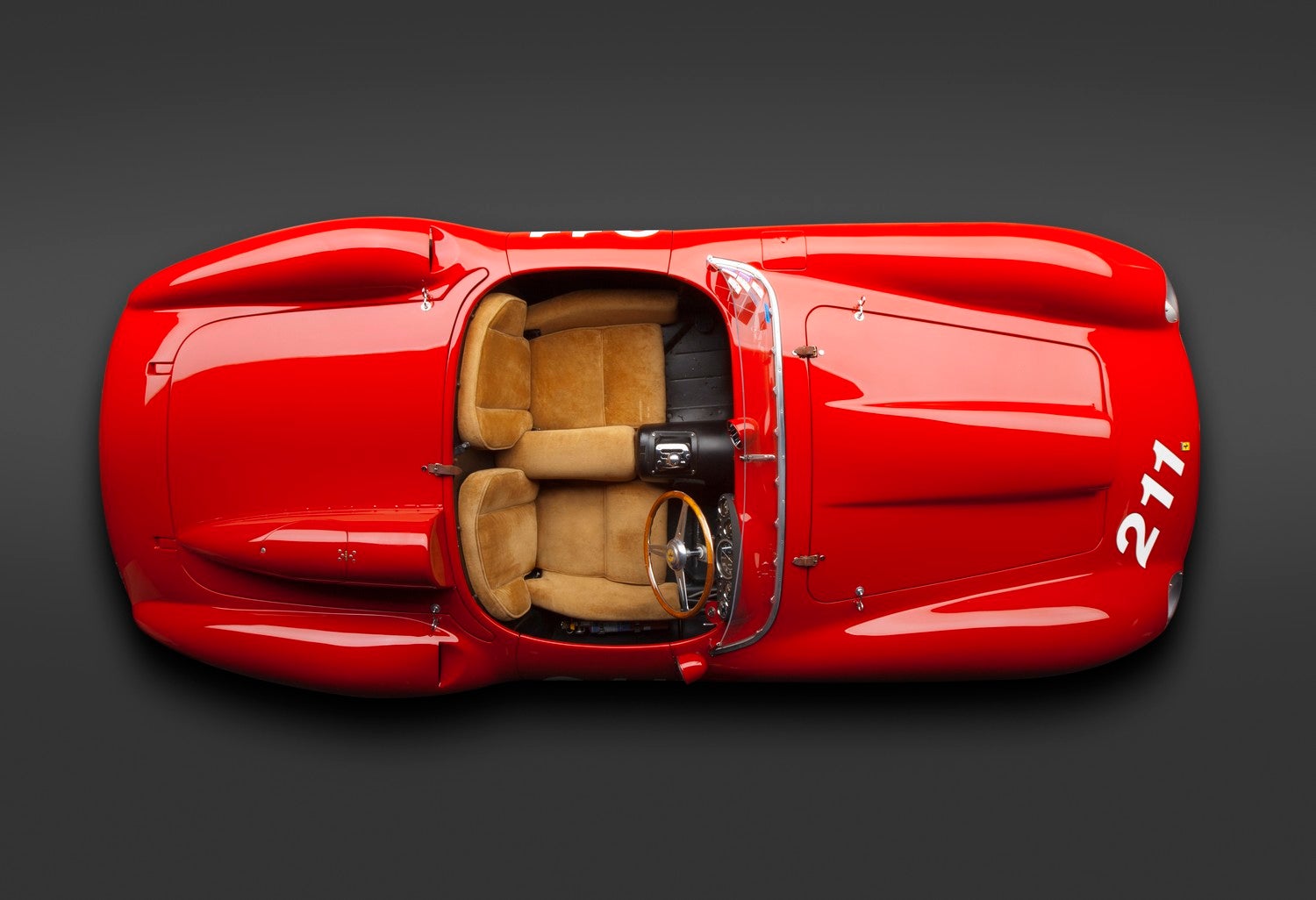

Sometimes I turn it on when I'm eating my Cheerios and let all the financial terms just wash over me, hoping I absorb some knowledge through osmosis so that I can turn my 401K into one of these babies someday. So far, no luck. Any tips, Oppo?

Dwhite - Powered by Caffeine, Daft Punk, and Corgis

> area man

Dwhite - Powered by Caffeine, Daft Punk, and Corgis

> area man

06/09/2014 at 10:11 |

|

Dont listen to Jim Cramer...

area man

> Dwhite - Powered by Caffeine, Daft Punk, and Corgis

area man

> Dwhite - Powered by Caffeine, Daft Punk, and Corgis

06/09/2014 at 10:13 |

|

Oh don't worry. At this time of day it's just boring reports from the NYSE floor.

Jeff-God-of-Biscuits

> area man

Jeff-God-of-Biscuits

> area man

06/09/2014 at 10:19 |

|

My aunt is making 4.3 bajillion dollars every 43 seconds working from home with this one weird trick the Feds don't want you to know...

area man

> Jeff-God-of-Biscuits

area man

> Jeff-God-of-Biscuits

06/09/2014 at 10:20 |

|

hahaha that was good. i love those spam bots and links. Who falls for that??

Jeff-God-of-Biscuits

> area man

Jeff-God-of-Biscuits

> area man

06/09/2014 at 10:22 |

|

The desperate and stupid. It's no way to go through life.

themanwithsauce - has as many vehicles as job titles

> area man

themanwithsauce - has as many vehicles as job titles

> area man

06/09/2014 at 10:23 |

|

yamahog

> area man

yamahog

> area man

06/09/2014 at 10:52 |

|

Ermmm, I don't think that's what a 401k is supposed to be for... I'm no accountant, but my grandparents very generously set up a brokerage for me (a large cap mix through Vanguard) after I graduated college that has been doing very well. Do some research on mutual funds and look into a Roth IRA? If you don't have one already, that is.

area man

> yamahog

area man

> yamahog

06/09/2014 at 10:57 |

|

A 401K is anything you want it to be after you reach retirement age, assuming it's not the only money you have. It's better than a Roth b/c it's pre-tax, but I could probably do with a second fund.

rb1971 ARGQF+CayenneTurbo+E9+328GTS+R90S

> area man

rb1971 ARGQF+CayenneTurbo+E9+328GTS+R90S

> area man

06/09/2014 at 11:20 |

|

The miracle of compounding and a market-matching fund are really the only ways to go for individuals. Find one with no churn and ultra-low fees. No one consistently beats the market, unless they have access to inside info or super-high-speed trading machines that allow them to trade on info before anyone else can.

KusabiSensei - Captain of the Toronto Maple Leafs

> Dwhite - Powered by Caffeine, Daft Punk, and Corgis

KusabiSensei - Captain of the Toronto Maple Leafs

> Dwhite - Powered by Caffeine, Daft Punk, and Corgis

06/09/2014 at 11:21 |

|

This is the *BEST* advice that one can give to anyone investing.

Cramer: Great for entertainment, and losing money.

KusabiSensei - Captain of the Toronto Maple Leafs

> area man

KusabiSensei - Captain of the Toronto Maple Leafs

> area man

06/09/2014 at 11:32 |

|

Start now, plan for the long term, buy and hold, don't get exotic with equity selection.

Basically, don't be stupid. Because stupid is how you lose money.

Also, go play with Google Finance. You can give yourself $100K of virtual money, and start picking a good, diversified portfolio. Something tracking the S&P500, S&P600/Russell 2000, and something tracking the MSCI EAFE(for international exposure).

#include

I am not a registered investment adviser and more importantly, I am not YOUR RIA. Not an offer to buy or sell any security, nor a solicitation of an offer to buy a security. This overview for informational purposes only. Always check with your adviser before making any decision to buy or sell any security. I do not provide individual or customized legal, tax, or investment services. Since each individual's situation is unique, a qualified professional should be consulted before making any financial decision.

KusabiSensei - Captain of the Toronto Maple Leafs

> area man

KusabiSensei - Captain of the Toronto Maple Leafs

> area man

06/09/2014 at 11:36 |

|

A traditional 401(k) is only useful if making a pre-tax contribution will prevent you from being bumped into the next tax bracket (as it reduces your taxable income).

Otherwise, I would go with post-tax contributions (If your employer offers a Roth 401(k) option). Especially if you are in your 20s, you will be making a lot more money in your late 30s and 40s than you do now, and thusly, your income tax bracket will be higher.

You can get your tax-advantaged money saved now, and save the taxable income adjustments for when you really need it (middle of your career), and then you will have a good blend of taxable and non-taxable funds at retirement.

area man

> KusabiSensei - Captain of the Toronto Maple Leafs

area man

> KusabiSensei - Captain of the Toronto Maple Leafs

06/09/2014 at 13:15 |

|

Thanks for the help man!

BoulderZ

> area man

BoulderZ

> area man

06/09/2014 at 14:35 |

|

There's a saying, "The best time to plant a tree is 10 years ago." Saving is like that, too. But, unless you have a time machine, in which case you have no need to invest because you already know which lottery numbers to play, then saving as much as you can now is the best move you have. Then, let regular contributions, compounding interest, and good old time take over. As far as if you should be putting money in a 401(k), Roth, or after-tax investments, the answer is you should be doing all three in a blend appropriate to your circumstances. There are better and worse approaches for each person, and they change over time,but the only truly wrong answer is saving/doing nothing and having no plan.

401(k): If your employer has contribution matching (i.e. they put 50 cents in to your 401(k) for every dollar you put in up to some ceiling), you absolutely need to put in enough to at least take full advantage of the match. Otherwise you are willingly giving yourself a pay cut. Upsides of 401(k): it's pre-tax savings, which lowers your taxable income now, most employers have a match as mentioned above, it makes savings easy because it's automatic and happens before you ever see the money, there are sometimes ways to use it to make certain loans to yourself or hardship withdraws, and most plans have good funds with low costs and services through the fact that the employer is essentially a giant client for whoever admins the funds (like Fidelity or whoever). Downsides : Some plans have very limited fund options (or worse, they're all company stock themed, the opposite of the diversified portfolio you want), it does lower your take home pay now which could be tough if you live paycheck to paycheck, you may have to be your own financial adviser if the plan support is lacking, it is generally very difficult and/or expensive (penalties and taxes) to get at the money before legal retirement age, and you will pay taxes on your contributions and accumulated interest/growth when you do withdraw in retirement (a 401(k) is a bet that your retirement tax bracket rate will be lower than during your career), if you leave your company you will have to move the fund or otherwise admin/take it over.

Roth IRA : This is so good it's hard to imagine it ever got through legislation. Here's the deal: you contribute after-tax money, currently up to $5500 each year per person, to a designated Roth IRA account (you can set them up through almost any financial institution or service, for cheap or even free), then compounding interest and time takeover, and when you withdraw in retirement you pay no taxes on the contributions or the interest. That's right, tax free gains and compounding! And, something I just learned, is that you can withdraw your contributions tax free before retirement age, which is some nice flexibility to have if you hit a really bad patch. Upsides : tax free gains and compounding, no tax bill at retirement, independent of your employer, almost no limits on what funds and portfolios are available to you, no penalty early withdraw of contributions/principal. Downsides : Only $5500 per year is generally not enough to build a full retirement fund, if you end up pulling in sizeable money you may not be eligible (about $181,000 per year right now), setting it up and administering it and contributing is all your responsibility (you can minimize this with an adviser, auto withdraws, etc.) which can be a drag/difficult.

After tax investment/savings : Sky's the limit here, pretty much, but that comes with almost limit considerations as the price. You can go "safe" and keep cash in your mattress or a mayo jar buried in the yard but then you're exposed to theft/physical loss of the money and you're losing money to inflation all the time (bad idea, but super-liquid). You can put it in a savings account and get FDIC guarantee, but the rates are so low (like, 0.2%, maybe less) that you're still not keeping up with inflation. You could try money market accounts, or make a CD ladder, which are a bit better. Or, as basically no one can consistently "beat the market", just buy a broad market index fund with low/no fees or loading (relatively low risk for equities, usually nice returns), and ride the (generally) upward tides, though you're at risk for some really bad years, too. You could go for real estate and buy your own home or a rental property, or get in to a REIT type fund, each with their own ups/downs. The keys here are how much risk or volatility you want or can tolerate, how high the returns (or losses) are or might be, how much liquidity you need, management of the funds (your own time/labor or pay someone) and tax implications now (e.g. owning a rental property can make filing taxes very difficult so you may need to pay a tax preparer, another cost, and any capital gains or dividends and so forth may be taxable income now). You could use your savings to start a business, and get fabulously wealthy, or lose everything.

area man

> BoulderZ

area man

> BoulderZ

06/09/2014 at 14:41 |

|

Holy shit man, what an informed and thoughtful response. Thank you!